Political Scandals: How Corruption Impacts the Stock Market & Investments

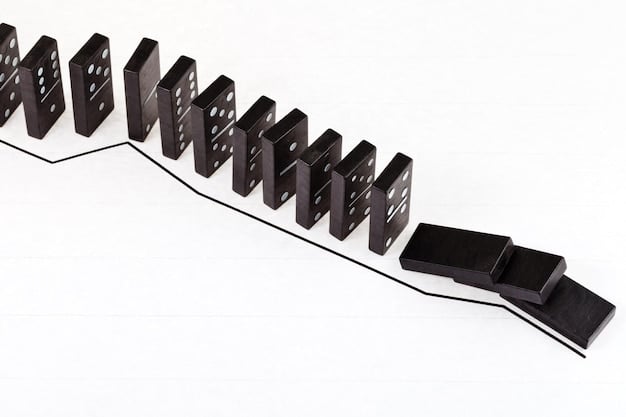

Political scandals can significantly influence the stock market by eroding investor confidence, leading to decreased valuations and increased market volatility as corruption undermines the stability and transparency vital for investment decisions.

The intersection of politics and finance is often fraught with complexity, and when scandals erupt, the repercussions can ripple through the stock market. Understanding how these events affect investment decisions is crucial for navigating the financial landscape.

Understanding the Link Between Political Scandals and Stock Market Volatility

Political scandals frequently trigger uncertainty in the stock market. The unpredictable nature of these events can make investors wary. This hesitancy often results in significant market fluctuations as confidence wanes and capital is withdrawn or repositioned.

The connection isn’t always immediately apparent, but the underlying mechanisms can significantly influence market behavior. It is essential for investors and market observers to understand these connections to anticipate and manage potential risks.

Initial Market Reaction

The initial reaction to a political scandal is frequently a sharp sell-off. Investors, fearing prolonged uncertainty, rush to liquidate their positions. This surge in selling pressure can send stock prices tumbling. The extent of this initial drop often depends on the severity and scope of the scandal.

Long-Term Investor Confidence

Beyond the initial shock, the erosion of investor confidence can have lasting consequences. If political scandals and the stock market: how corruption affects investment is perceived to be widespread and systemic, it can deter long-term investment. Lower investment levels can hinder economic growth, creating a feedback loop of market instability.

Ultimately, market volatility increases when investors lose trust in the political and regulatory systems that underpin the economy. This volatility can make it more difficult for companies to raise capital and for investors to achieve their financial goals.

Case Studies: Political Scandals That Shook the Stock Market

Examining historical instances of political scandals provides valuable insights into their potential effects on the stock market. These real-world events demonstrate how corruption, fraud, and other illicit activities can trigger significant market disruptions and long-term economic consequences.

By scrutinizing these case studies, investors and policymakers can better understand the dynamics at play and develop strategies to mitigate risk and safeguard market stability.

- The Watergate Scandal: The Watergate scandal, involving President Nixon, led to considerable uncertainty and market decline in the early 1970s.

- The Enron Scandal: Though primarily a corporate scandal, Enron’s collapse was intertwined with political connections, eroding confidence in regulatory oversight and contributing to market instability.

- The 2008 Financial Crisis: While multifaceted, the crisis revealed deep-seated corruption and deregulation, shaking investor trust and causing a global economic downturn.

Studying these examples reveals common threads: a loss of investor confidence, increased market volatility, and the potential for long-term economic damage. Recognizing these patterns can help investors anticipate and manage similar risks in the future.

The Role of Regulatory Bodies in Mitigating the Impact

Regulatory bodies play a crucial role in maintaining market integrity and mitigating the adverse effects of political scandals. Effective regulation can help to prevent corruption, detect fraudulent activities, and ensure transparency in financial markets. When these bodies function efficiently, they bolster investor confidence and foster stable market conditions.

Strong enforcement of regulations sends a message to the market that illicit activities will not be tolerated. This, in turn, can help deter corruption and maintain a level playing field for all investors.

Enhancing Transparency

Transparency is a cornerstone of effective regulation. Regulatory bodies should require companies to disclose relevant information about their operations, finances, and political affiliations. This transparency enables investors to make informed decisions and reduces the risk of hidden corruption impacting market valuations.

Strengthening Enforcement

The effectiveness of regulatory bodies hinges on their ability to enforce regulations vigorously. This includes investigating allegations of corruption, prosecuting offenders, and imposing meaningful penalties for wrongdoing. Strong enforcement actions send a clear signal that corruption will not be tolerated, fostering a culture of compliance.

How Investors Can Protect Themselves During Political Turmoil

Navigating the stock market during periods of political turmoil demands a strategic and cautious approach. Investors can implement several strategies to protect their portfolios and mitigate risk in the face of uncertainty and volatility.

Diversification, risk management, and a long-term perspective are crucial tools for weathering the storm. Understanding the potential impact of political events and proactively adjusting investment strategies can help safeguard financial assets.

- Diversify Your Portfolio: Spreading investments across various asset classes, sectors, and geographic regions can reduce the impact of a single event.

- Stay Informed: Monitoring political developments and understanding their potential economic impact is crucial for making informed investment decisions.

- Consider Professional Advice: Financial advisors can provide personalized guidance and help navigate complex market conditions during periods of uncertainty.

Adopting these strategies can help investors protect against the adverse effects of political turmoil and maintain a long-term focus on their financial goals. Flexibility and adaptability are key during such times.

The Global Perspective: Comparing Markets

The impact of political scandals and the stock market: how corruption affects investment varies across different markets. Factors such as the strength of regulatory institutions, the level of political stability, and the degree of transparency can all influence how markets respond to such events.

Comparing how different markets react to similar scandals can offer valuable insights. It highlights the importance of robust governance, effective regulation, and investor confidence in maintaining market stability.

Developed vs. Emerging Markets

Developed markets, typically characterized by strong regulatory frameworks and stable political systems, may be more resilient to political scandals. Emerging markets, on the other hand, may be more vulnerable due to weaker institutions and greater political instability.

Regional Differences

Different regions around the world exhibit varying levels of vulnerability to political scandals. Some regions may be more prone to corruption due to cultural norms, historical factors, or geopolitical circumstances. These regional differences can significantly influence how markets respond to political events.

Future Trends and Predictions

Looking ahead, several trends are likely to shape the interaction between political scandals and the stock market. The increasing interconnectedness of global markets, the rise of social media, and the growing focus on corporate social responsibility are all factors that could influence how political scandals impact investment decisions.

Technology, media, and evolving investor expectations will continue to play a significant role. Predictive analysis, data-driven insights, and the ability to adapt quickly will be crucial for investors navigating these complex dynamics.

The Role of Technology

Technology is likely to play an increasingly important role in both exposing and mitigating the impact of political scandals. Social media can amplify news and opinions, potentially leading to faster and more widespread market reactions. At the same time, data analytics tools can help investors identify risks and opportunities associated with political events.

The Rise of ESG Investing

Environmental, Social, and Governance (ESG) investing is gaining traction, with investors increasingly considering non-financial factors in their decision-making. Political scandals related to corruption or unethical behavior can negatively impact a company’s ESG score, potentially leading to decreased investment and lower stock valuations.

| Key Point | Brief Description |

|---|---|

| 🚨 Market Volatility | Political scandals often trigger sudden and significant market fluctuations. |

| 📉 Investor Confidence | Scandals erode trust, leading to decreased investment and slower economic growth. |

| 🛡️ Regulatory Role | Strong regulatory bodies can mitigate the negative impacts through transparency and enforcement. |

| 🌍 Global Differences | The impact varies across markets based on stability and regulatory strength. |

FAQ

▼

Political scandals often lead to uncertainty, causing investors to sell off stocks. This increased selling pressure can drive stock prices down, reflecting the market’s reaction to the negative news.

▼

Regulatory bodies are responsible for maintaining market integrity. They ensure transparency and enforce rules to prevent corruption, thereby mitigating the impact of scandals on the stock market.

▼

Investors can protect themselves by diversifying their portfolios, staying informed about political and economic developments, and seeking professional financial advice when navigating turbulent market conditions.

▼

Not all political scandals have the same impact. The severity, scope, and perceived implications of the scandal will influence the market’s response. Scandals involving corruption or economic mismanagement tend to have a more significant effect.

▼

Future trends include the increasing role of technology in exposing scandals, heightened scrutiny from ESG investing, and the growing interconnectedness of global markets, all of which amplify market reactions.

Conclusion

In conclusion, political scandals and the stock market: how corruption affects investment are intertwined in a complex relationship. Understanding the dynamics of this connection, the role of regulatory bodies, and strategies for navigating periods of political turmoil is crucial for investors seeking to protect their portfolios and achieve long-term financial success.